The Power Struggle: Examining the Reliability and Security of America’s Electrical Grid

My testimony before the Subcommittee on Economic Growth, Energy Policy, and Regulatory Affairs within the House Committee on Oversight and Accountability

Chairman Fallon, Ranking Member Bush, and distinguished members of the subcommittee:

Thank you for the opportunity to testify on the reliability and security of America’s electrical grid. The Cato Institute is a nonpartisan public policy research organization dedicated to the principles of individual liberty, limited government, free markets, and peace. At Cato, I am the Director of Energy and Environmental Policy Studies, and my research focuses on the economics and reliability of electricity, the role of free markets in improving the availability and affordability of energy and natural resources, and environmental regulations that impact the energy sector.

I commend you for your efforts to better understand the impacts of public policy on the reliability and security of America’s power grid.

Executive Summary

Americans depend on a strong energy infrastructure for our health and well‐being, and the electrical grid is the most important—and fragile—piece of energy infrastructure we have. Unfortunately, the power grid is hampered by harmful public policies at nearly every level of government.

The stakes for policymakers are high. Losing sight of the fundamental issue of grid reliability—particularly by endorsing policies that shut down reliable generators or subsidize unreliable ones—puts citizens’ lives at risk.

A recent reminder of this fact was the tragic loss of lives during Winter Storm Uri. And we see the growing frequency of energy emergency alerts across the country, including load shed events in the footprints of Duke Energy and the Tennessee Valley Authority.

During extreme weather, Americans need reliable electricity to survive. Day to day, we need reliable and affordable electricity to thrive and grow.

The power grid should be an asset to American prosperity, but policymakers—through a multitude of subsidies, regulations, and mandates—have wounded it to the point that it is now becoming a dangerous liability.

I. Reliable and Low‐Cost Electricity is Essential

At the turn of the millennium, the National Academies of Engineering ranked the electric grid the greatest engineering achievement of the twentieth century.1 The main criterion for selection was how much an achievement improved people’s quality of life. There is no question that access to reliable electricity improves the quality of life of every American.

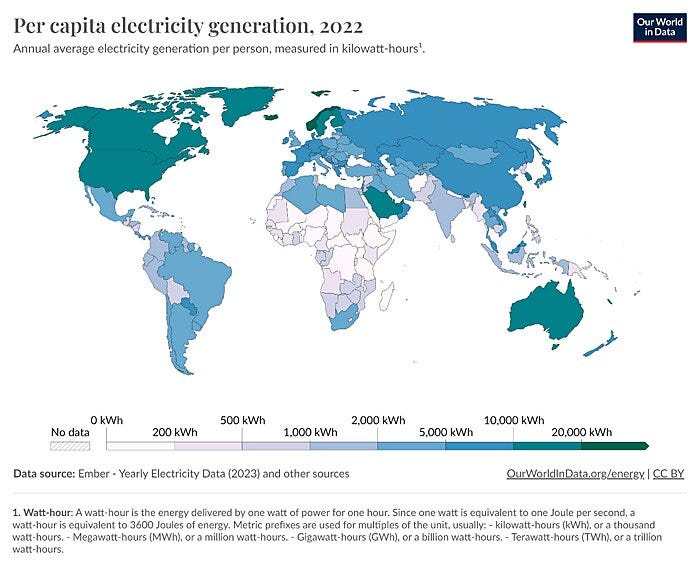

Abundant electricity is vital to economic growth and energy security. Commercial and industrial customers need low‐cost and reliable energy to flourish; residential customers need it to thrive without breaking the budget. Contrasting against the many energy‐starved parts of the developing world, American consumers are fortunate to live in a society in which affordable and reliable electricity is so ubiquitous that many take it for granted. The map below shows that the United States remains among the top tier of nations in electricity generation per capita.2

A. Expensive Electricity is an Energy Security Risk

There is a clear nexus between the affordability of electricity and energy security at the household level. A recent Congressional Research Service (CRS) report on electric utility disconnections highlighted the hardships and threats to energy security faced by many American families:

“Researchers estimate that approximately 1% of households are disconnected each year. Broader measures of energy insecurity (e.g., foregoing other necessary expenses like food or medicine) are higher, with approximately 30% of American households experiencing some form of energy insecurity. Black and Hispanic households appear more likely to be disconnected than non‐Hispanic White households. For many American families, electric utility disconnections are the most significant threat to energy security.”

Data compiled by CRS highlight the affordability challenge: “The share of Black households experiencing energy insecurity is about twice as high as that for White households (52% compared to 27% in 2020). Similarly, the share of Hispanic or Latino households experiencing energy insecurity is about twice as high as that for households that are not Hispanic or Latino (47% compared to 25% in 2020).”

Policymakers should understand the profound impacts that increases in electricity costs can have on the daily lives of Americans. The availability of low‐cost electricity can make the difference between light and darkness (or between comfort and worry) in living rooms across the country.

B. American Industry Will Grow If the Grid Allows It

Likewise, if policymakers want to retain American industry for purposes of national security, maintaining a low‐cost and reliable power grid is one of the strongest selling points in keeping or drawing industrial customers to the United States. Germany’s failed Energiewende is the poster child for unwise energy policy becoming dangerous industrial and foreign policy (not to mention ineffective climate policy).3 Specifically, Germany’s energy policy set the stage for Russian hostility and enabled Russia to “blackmail” Europe using natural gas supplies.4

Whether the power grid in America is up to the task of supplying a rapidly growing industrial sector is an open question. The North American Electric Reliability Corporation (NERC), the grid watchdog for North America, stated in its December 2023 Long Term Reliability Assessment: “Electricity peak demand and energy growth forecasts over the 10‐year assessment period are higher than at any point in the past decade.”5 Echoing NERC’s findings, a recent report from Grid Strategies noted the significance to the American economy of supplying new load growth:

“It’s worrisome that a resurgent American manufacturing sector may face headwinds from the limited ability of the nation’s electricity systems to respond. … There are real risks that some regions may miss out on economic development opportunities because the grid can’t keep up.”6

Congress should support efforts to meet the energy challenges of a growing manufacturing sector. Unfortunately, as discussed in more detail below, the federal government stands as one of the largest obstacles to a thriving and high‐energy manufacturing renaissance.

II. Energy Policies Are Undermining Reliability and Affordability

Under a reasonable set of regulations, electricity suppliers will rise to meet challenges and deliver low‐cost, reliable electricity to consumers across the United States. However, energy and environmental policies are creating predictable problems with grid reliability and affordability.

Last year, for the first time ever, NERC identified energy policy as a leading risk factor for electric reliability.7 In NERC’s 2023 ERO Reliability Risk Priorities Report, the energy transition—specifically the changing resource mix—tops the risk rankings.

PJM Interconnection, Inc. (PJM), the largest electricity market in North America by revenue and volume, provided an accurate outline of the concerns facing the electricity industry in its 2023 report titled Energy Transition in PJM: Resource Retirements, Replacements & Risks.8 PJM identified four major trends (the bullets below are quotes):

The growth rate of electricity demand is likely to continue to increase from electrification coupled with the proliferation of high‐demand data centers in the region.

Thermal generators are retiring at a rapid pace due to government and private sector policies as well as economics.

Retirements are at risk of outpacing the construction of new resources, due to a combination of industry forces, including siting and supply chain, whose long‐term impacts are not fully known.

PJM’s interconnection queue is composed primarily of intermittent and limited duration resources. Given the operating characteristics of these resources, we need multiple megawatts of these resources to replace 1 MW of thermal generation.

The electricity industry is at a critical inflection point. The drawbacks of a forced energy transition are becoming clearer (particularly if we look to examples of what not to do, such as Germany’s Energiewende), yet policymakers do not appear to recognize the gravity of the situation. Below is a snapshot of some of the public policies that pose the greatest threat to a reliable and affordable electrical grid.

A. The Inflation Reduction Act Weakens the Grid with Subsidies

The Inflation Reduction Act (IRA) threatens to undermine the well‐functioning of the power grid by flooding it with subsidized, intermittent energy. One inescapable fact of the electricity industry is that dispatchable resources are necessary to match supply with demand and keep the grid energized at all times.9 By providing unlimited amounts of subsidies to intermittent resources like wind and solar energy, the IRA erodes the economics of dispatchable resources.

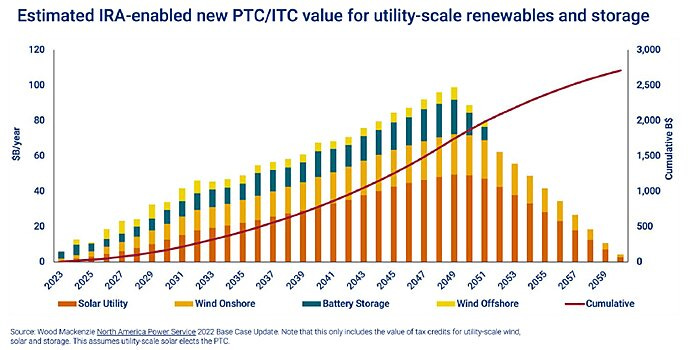

Unlimited is the operative word. If we look beyond the 10‐year budget window, the cost of the IRA credits could increase and remain high for years, perhaps indefinitely. That is because the “applicable year” when the production tax credit (PTC) in the IRA is supposed to phase down is triggered by a greenhouse gas (GHG) reduction target that is impossible to meet. Specifically, GHG emissions in the electricity sector must fall to 25 percent of their 2022 level for the PTC to begin to phase down.

The total cost of energy credits in the IRA is an unstable number with no reasonable cap.

Note that the target in the IRA is a GHG emissions level rather than a GHG intensity. The U.S. Energy Information Administration (EIA) analyzed electricity sector GHG emissions in the IRA reference case (and in the no‐IRA case) and found neither case to hit the “applicable year” target by 2050. Hence, the IRA subsidies are set to pile up for decades, potentially reaching $3 trillion in just the PTC alone.10

The distinction between a level‐based and intensity‐based target matters because electricity demand is growing, making the IRA targets even harder to hit. The chart below assumes GHG emissions targets will be met around the year 2050.11 It is an illustrative example of how large the IRA subsidies could be, but let me be clear—I do not believe the GHG emissions targets in the IRA will be met in any conceivable timeline.

The PTC will profoundly impact wholesale electricity markets and their ability to ensure reliability.12 In short, the subsidies for preferred resources will undermine the profitability of generators that use hydrocarbon‐based fuels. In 2023, hydrocarbons provided 60 percent of America’s electricity and a higher share of dispatchable energy.13 The longer the IRA subsidies remain in place, the higher the cost to American taxpayers and to grid reliability.

As discussed below, the IRA also enables the Environmental Protection Agency (EPA) to claim certain unproven technologies are adequately demonstrated when, in fact, they are merely adequately subsidized. Thus, the IRA forms the basis of the EPA’s Best System of Emission Reduction (BSER). Basing permanent rulemakings on temporary budget reconciliation measures like the IRA is inappropriate.

B. EPA Regulations Hurt Reliability and Affordability

The EPA’s regulatory regime is laden with legal infirmities, conflicts of interest, and technical and economic problems. The proposed power plant GHG regulation—sometimes referred to as CPP 2.0 because it’s the second attempt at a Clean Power Plan—relies on technologies that have not been “adequately demonstrated” by any stretch of the meaning of that term.14 The proposal is so legally dubious that I am concerned the goal of the policy is to inject uncertainty in the planning and financing of hydrocarbon‐based electricity generation rather than to enact a durable regulation.

As mentioned above, the energy subsidies in the IRA enable the EPA’s overreach because they allow the EPA to set standards based on hypothetical deployment of highly subsidized resources. In the CPP 2.0 proposal, EPA relied explicitly on the subsidies in the IRA to claim that the BSER technologies—carbon capture and storage (CCS) and low‐GHG hydrogen—are “adequately demonstrated.”15 A corollary of EPA’s reliance on IRA subsidies is that, when fiscal realities demand a claw‐back of IRA subsidies, the CPP 2.0 will have to be clawed back as well.

Assuming CPP 2.0 does not receive an immediate stay from the courts, its practical impact will be to greatly reduce the supply of electricity. Given that CCS is not commercially available at any useful scale, the only compliance option for owners of coal‐fired power plants is to shut down. The same goes for natural gas‐fired generators—low‐GHG hydrogen is at best very expensive and at worst unavailable. The inevitable result of the rule is the shutdown of a significant amount of reliable generation.

The proposed tailpipe emissions standard, if found to be legal, will of course limit the choices Americans have in our vehicles, but it will also greatly increase the demand for electricity. That is because a significant amount of the energy needed for transportation will have to shift from being supplied by petroleum (gasoline and diesel) to being supplied by the power grid. In other words, the tailpipe rule will further increase demand growth, which is already accelerating.

The vast amount of energy required for transportation is indicated by the pie chart below. Very little petroleum is used in electricity generation. Of the 100 quadrillion British Thermal Units of energy used by Americans in 2022, approximately 36 came from petroleum, mostly for transportation.16

The result of reduced supply and increased demand is straightforward to predict: increased prices and, unfortunately, energy shortfalls. What that means for a typical electricity consumer is a higher power bill and an increased risk of blackouts.17 According to NERC, we are already in an elevated risk scenario. Hence any EPA proposal to force an increase in demand or a decrease in supply—including the tailpipe rule and CPP 2.0—will further weaken an already fragile grid.

III. Competent Oversight Requires Impartial Assessments of Reliability and Cost

A. EPA’s Regulatory Impact Assessments Are Inadequate

In the case of both the tailpipe rule and CPP 2.0, the EPA used a proprietary model developed by an outside consulting firm to estimate the impacts of the rules on the retail price of electricity. Although the price estimates are something of a black box, there are indications that the process is deeply flawed.

The draft regulatory impact assessment for the tailpipe rule states that “[r]egional average retail electricity price differences showed small increases or decreases (less than approximately 1 to 2 percent),” meaning that EPA’s price model violates the law of supply. In no case should a rule that forces the rapid electrification of the transportation fleet—which represents a large increase in the demand for electricity—cause a reduction in prices.

Regarding the price impacts of CPP 2.0, EPA finds that vastly reducing the supply of electricity generation would only increase retail electricity prices by 0.2% in 2035 on average.18 This is an implausible estimate made possible by a proprietary model. Why would the EPA not rely on the Energy Information Administration, an independent wing of the U.S. Department of Energy? The EIA is more than capable of modeling the cost impacts of CPP 2.0, as it showed when it modeled the cost impacts of the original Clean Power Plan using the National Energy Modeling System.19

The EPA could also inflate the estimated benefits of its own regulations. In both the tailpipe rule and CPP 2.0, the EPA is poised to use a greatly increased estimate of the Social Cost of Carbon Dioxide (SC-CO2) to justify its proposals. One fundamental problem (among others) is that the EPA is moving ahead of the Interagency Working Group process to update the SC-CO2 and instead using its own estimate. In other words, the EPA can print its own regulatory currency—the SC-CO2—to be used in justifying its own rules under the required cost‐benefit analyses.

As I wrote in formal comments to the EPA regarding CPP 2.0, the EPA should improve its rulemaking by offering an objective, unbiased assessment of the reliability and cost impacts.20 To that end, the EPA should issue a new supplemental notice seeking comment on the impact of the rule on the cost of electricity.

B. Policymakers Should Focus on Impacts to Consumers

Economist Frederic Bastiat was correct when he wrote: “Treat all economic questions from the viewpoint of the consumer, for the interests of the consumer are the interests of the human race.” When in doubt about the desirability of a given policy—particularly when inundated with demands from business interests—ask whether the policy supports the interest of the consumer. The loud clamoring by competing supply‐side interests for government largesse fades away when the only voice you choose to hear is that of the consumer.

The debates around energy security, reliability, and affordability too often become entangled in the so‐called “fuel wars,” meaning the political fights between different fuels or energy resources. Sometimes whole categories of energy are the subjects of these fights, as in fossil fuels versus renewables. However, rather than engaging in debates about which corporate interest group should receive government favors, policymakers should put American families and businesses first.

In short, policymakers should pay more attention to consumers and less to producers. Polling shows that most Americans are not willing to pay $1 per month to address climate change.21 The focus of consumers is clearly on affordability rather than reductions in GHG emissions, and policymakers should take note.22

IV. The Pro‐Consumer Path Forward Requires Market‐Driven Growth

As I see it, there are two starkly different paths forward regarding electricity policy. The first, which I endorse, is to embrace American values and foster an electricity industry that is built on fierce competition to best serve the interests of consumers. The second, which I fear is taking hold presently through the IRA and EPA rules discussed above, is to force an unwise transition to politically favored, intermittent resources.

Of course, intermittent resources such as wind and solar energy should be permitted to take their rightful place in electricity markets. Congress should remove the IRA subsidies (along with all energy subsidies, including subsidies for hydrocarbons and nuclear energy) to encourage right‐sized investments in energy resources that leave electricity customers and federal taxpayers better off. The IRA will force significant amounts of intermittent energy onto the grid—far more than would be consistent with the goal of ensuring a reliable grid at least cost to consumers and taxpayers. At the same time, the EPA is recklessly shutting down reliable generation.

Rather than allowing an energy crisis of their own making to unfold, policymakers should foster a reliable, low‐cost grid that provides a solid foundation upon which to build a strong and growing American economy. The way to ensure a robust grid is simply to remove the harm inflicted by unwise energy policy.

Finally, I urge policymakers to show restraint and humility when interfering with the electric power sector. Policymakers have important decisions to make about America’s energy future, and it is vital that members of Congress and other policymakers first do no harm. As NERC has noted, “[e]ducation for policymakers and regulators to increase awareness of the reliability implications of policy decisions is a critical need.”23

Thank you for the opportunity to provide testimony on the critical issue of the reliability and affordability of the electric grid.

‘As NERC has noted, “[e]ducation for policymakers and regulators to increase awareness of the reliability implications of policy decisions is a critical need.’

This is the key problem. I applaud your education efforts. Do you think our policy makers are bothering to get educated?

As Robert Bryce would ask, are you optimistic? Frankly, I’m not. I fear we will follow Germany into the ditch.

Excellent testimony on the electric grid, Travis.

Glad that you underscore the effect that high electricity costs have on low-income people. Attaboy.